Taxes are anything but simple. Zohra Farmer and Paula Reiss, tax associates at H&R Block, explain some rules to keep you tax savvy and to maximize your refund.

1 Know the basics

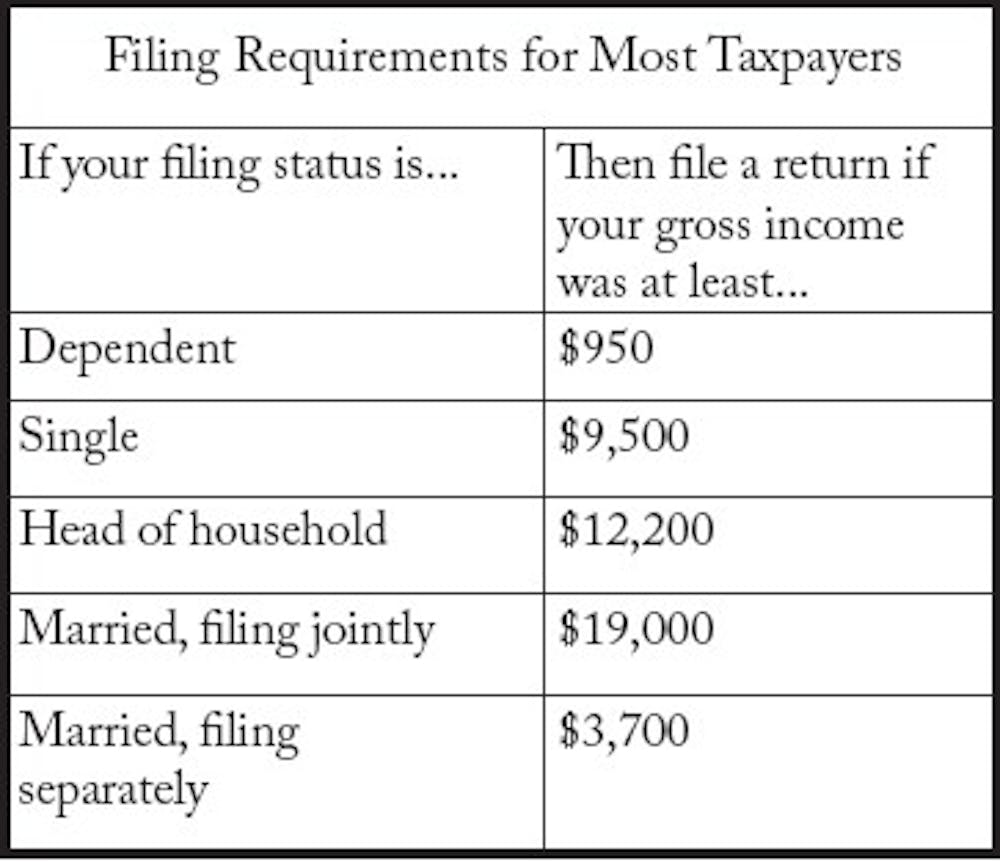

You must pay taxes if you have any income — from a full-time job to a summer internship. You must also have some source of income to get tax credits, which are sums of money deducted from your taxes, Farmer said.

You can file both state and federal taxes for free online through the IRS website and your state taxes at your resident state’s taxation and revenue website. Private accountants and tax associates can help students make sure they get every dollar they deserve, but often charge a fee for their services.

2 Keep track of your expenses

To get as many credits as you can, students should keep receipts and other documents as proof of out-of-pocket, school-related purchases, which can be deducted. This includes books, lab fees, student health fees, and transportation fees to and from school.

These expenses, as well as tuition, scholarships and grants, should be put on a 1098T form. These forms, which catalogue student expenses, are mailed to students at the end of each year and are also available from the UNM Bursar’s Office.

“It’s easier for me to look at your expenses and decide what’s deductible and what’s not,” Farmer said.

She said it’s a good idea to scan or copy receipts as they can fade in sunlight.

3 Look into government-offered education credits

The American Opportunity Credit and Lifetime Learning Tax Credit are two tax credits the government offers students.

The AOC is available for the first four years a student is enrolled in college. You can get up to $2,500 of credit reduced from your tax form, but only around half of it is refundable. This means that it can reduce your taxes to zero, and if the credit is more than your taxes, up to half of the excess can be refunded to you.

The LLTC is available to undergraduate or graduate students who take at least one class from an accredited school and is available for an unlimited number of years. The maximum credit for the LLTC is $2,000. This credit is non-refundable, meaning it can reduce taxes owed to zero, but the excess will not be refunded to you.

Get content from The Daily Lobo delivered to your inbox

4 Make sure you are not claimed as a dependent

If your parents claim you as a dependent and you’re paying tuition, you are not eligible for education credits, Reiss said.

“I had someone who ran into that problem,” she said. “She was working part-time and paying her tuition, but her grandparents wanted to claim her as a dependent. Technically, they can’t take (credits) if they didn’t pay (her tuition).”

Alternately, parents are eligible for tax credits for students attending college if they claim them as dependants.