by Abigail Ramirez

Daily Lobo

Student Stephanie Gonzales has spent $100 on presents so far, but she is planning on spending about $300 more.

"I blow off my entire check on Christmas shopping," she said. "I do try to look for sales. The day after Thanksgiving, I went shopping, and it was insane with lines. But to me, it was good, because I got good sales."

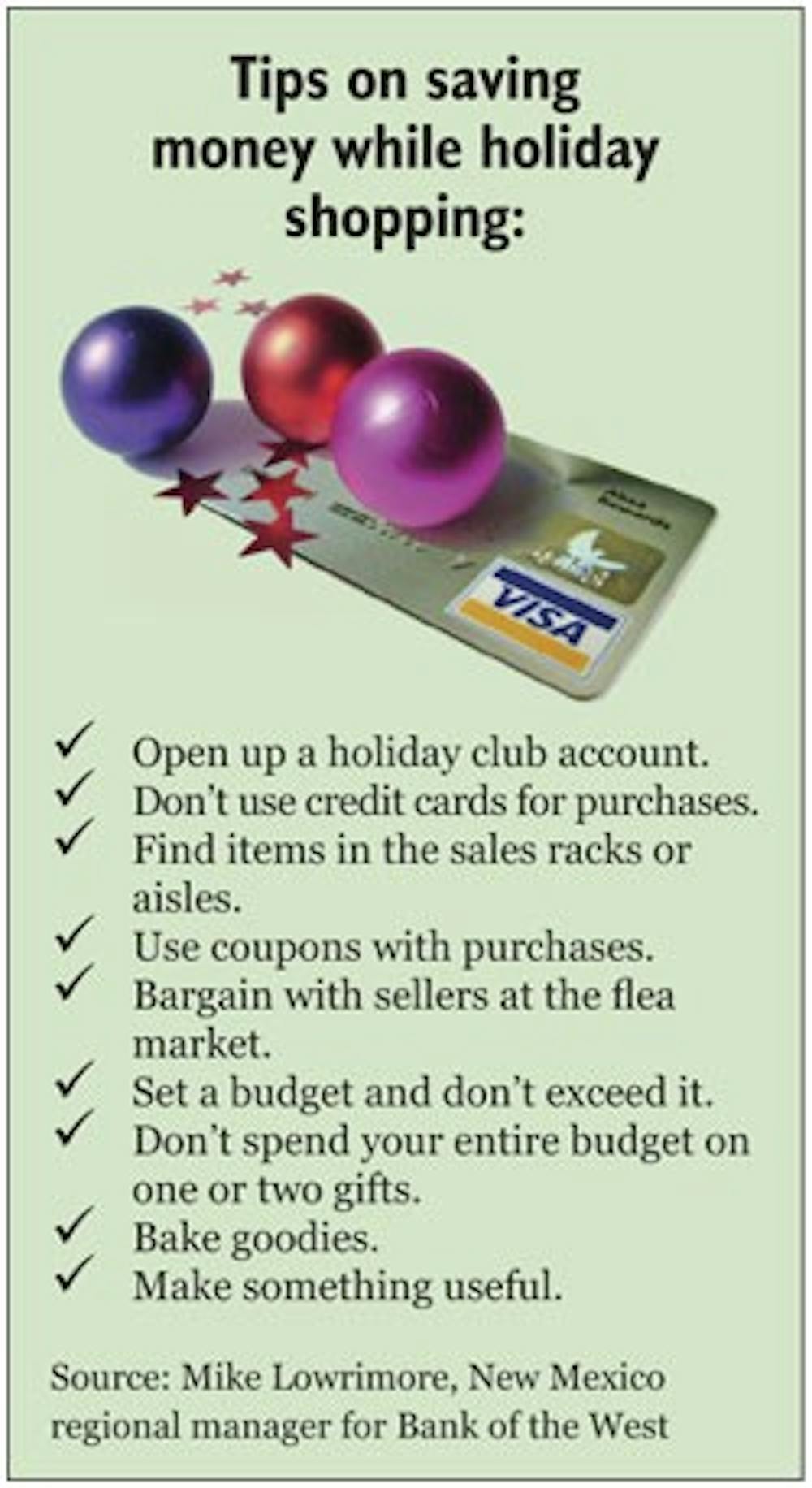

Mike Lowrimore, New Mexico regional manager for Bank of the West, said students can save money by looking for the clearance aisles, using coupons and going to the flea market and bargaining for a lower price.

Get content from The Daily Lobo delivered to your inbox

Having a set budget and not exceeding that may also help, he said.

People make the common mistake of spending their entire budget on one or two gifts to make somebody else happy, he said.

"Students can be creative, and rather than buy a gift, (they) can make a gift," Lowrimore said. "They can buy ingredients and cook for somebody. If you're talented, you could make something else that's more useful."

It can take some students an entire semester to get back on their feet from holiday shopping, Lowrimore said.

"In some cases, it puts a lot of stress on students, because that money could be better spent on something else," he said.

Gonzales said buying gifts for others is not as important as some people make it out to be.

"I think it's more about celebrating the birth of Christ, personally," she said. "But I think it's important to get them a little something. I don't think going overboard like most families do is good."

Student Krista Delong said the price isn't what matters.

"I think what matters most is the effort behind the present, not necessarily the monetary value of the present, but the effort that went into getting it," she said.

It's a bad idea to use a credit card for holiday shopping, especially if it can't be paid back within six months, Lowrimore said.

"If you can't pay off the amount that you're going to spend rather quickly, then you can't afford the item and shouldn't be buying (it)," he said.

Students usually don't have the money to pay for gifts, he said.

"Impulse buying, where a student sees something that they would really like but can't afford, but you buy it for someone else - while that's really sweet and nice, it's not very smart," he said.

At many credit unions and banks, students can open a holiday club account to help save up money for presents.

The account is used to put money aside monthly for the holiday season, he said.

The bank gives the account holder a check for the amount of money on Dec. 1.

"It's the thought that counts, and just the fact that you're out trying to buy somebody a gift is going to mean as much to them as what you buy," he said. "So, don't think that you have to buy the most expensive name-brand thing when it's the gift giving that counts."